Investors in Shell and ExxonMobil insensitive to Dutch earthquakes

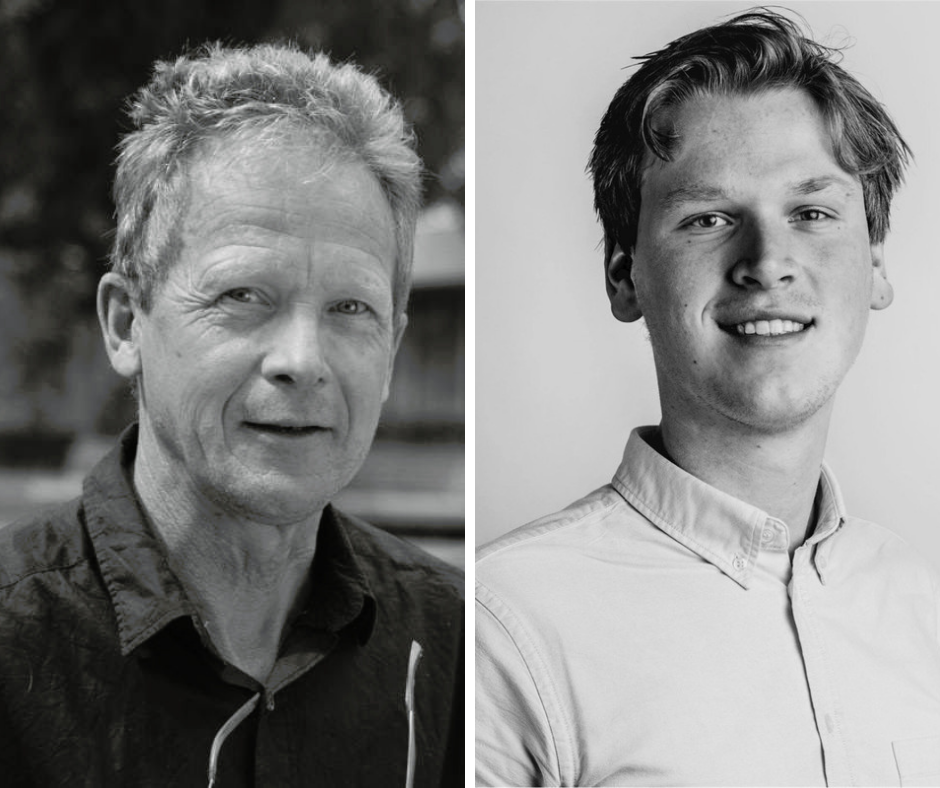

Investors in Shell and ExxonMobil hardly react when there are earthquakes associated with the extraction of fossil fuels. This is the conclusion of research by Matthijs Jan Kallen and Bert Scholtens of the University of Groningen. They investigated hundreds of supposedly induced earthquakes in Groningen (Slochteren) and Oklahoma (Anadarko) in the United States. These earthquakes are attributed to the extraction of fossil energy and caused upheaval in the respective communities.

Kallen and Scholtens compared how investors in the two energy giants react to induced seismicity, namely whether there are abnormal stock market returns when such an earthquake occurs. These earthquakes can be of interest to investors because they could indicate an intensification of extraction activity, but also because they cause damage. Therefore earthquakes can be experienced by investors as good news and as bad news.

Kallen and Scholtens investigated hundreds of induced earthquakes in the period 2000-2020. They suggested, as a selection criterion, that they had to be observable earthquakes that could not be associated with the usual geophysical origin of earthquakes. To this end, they chose earthquakes with a force between 1 and 4 on the Richter scale. Other research showed that induced seismicity usually falls within this bandwidth. In addition, there had to be sufficient time between the earthquakes so that no interaction was possible in both earthquakes and investors’ responses. On this basis, 423 earthquakes remained in the Slochterenveld and 552 in the Anadarko Basin. Kallen and Scholtens investigated Shell and ExxonMobil because these companies are directly or indirectly involved in energy production in both areas and because they are traded a lot.

The analysis shows that investors in Shell do not seem to react to induced seismicity. In contrast, these tremors are accompanied by significant positive stock market returns for investors in ExxonMobil. In a financial and economic sense, however, the response is extremely limited. The difference between the reactions of investors in both companies to the same earthquakes is not significant for the Slochteren field, but it is significant for seismicity in Oklahoma. This means that investors at least do not seem to react negatively to earthquakes.

According to Kallen and Scholtens, investors do not consider induced seismicity relevant to the value of the companies, even if this causes social damage. Investors will have already factored the securities into their valuation.

For more information, please contact Bert Scholtens.

For the full publication, see: Kallen, M.J. & Scholtens, B. Movers and Shakers: Stock Market Response to Induced Seismicity in Oil and Gas Business. Energies 2021, 14, 8051.

More news

-

09 December 2025

Are robots the solution?

-

10 November 2025

Decentralization of youth care