Impact case: Changing the Dutch public debate about financialization

| Date: | 30 July 2024 |

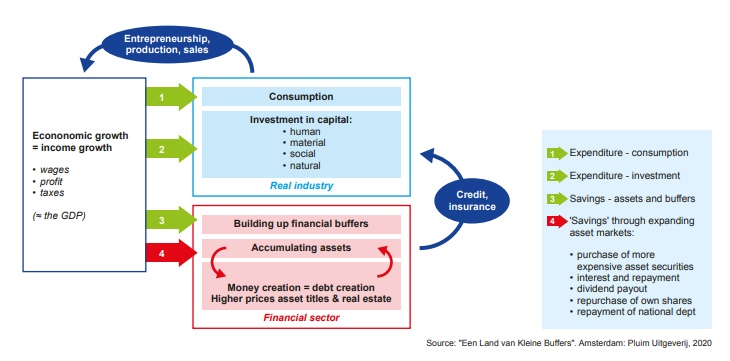

Dirk Bezemer published his book “Een Land van Kleine Buffers: Er is genoeg geld, maar we gebruiken het verkeerd” (translated as A Land of Small Buffers: there is enough money, but we are using it the wrong way) in 2020. The book highlights financialization in the Dutch economy and its consequences for the housing market and the pension system, and proposes policies to address these issues. In his follow-up research, he continues to focus on these themes.

By publishing this book Bezemer impacted the public, professional and policy debates on the structure of the Dutch economy, specifically with respect to income inequality, housing markets and pension funds. His book was mentioned in professional media outlets and columns and he was a guest on radio shows and podcasts. As a result, Bezemer actively contributed to the discussion on concrete policy changes in parliament, local governments, trade unions, ministries and banks. For instance, together with other housing market experts, he wrote a report for the Dutch government in 2022 with comprehensive housing market policy suggestions. In spring 2022, he also participated in a round table discussion in the House of Representatives on the Future of Pensions Act (Wetsvoorstel Wet Toekomst Pensioenen).

Underpinning Research

In his research, Dirk Bezemer argued for a financial-flows explanation of housing market developments (bubbles) and of the financial crisis following the collapse of the US housing market. In this way, he applied an evolutionary analytical framework that differentiates between different uses of bank credit, namely those in support of GDP growth versus those supporting (real estate and financial) asset market expansion. He then connected this to the theory of financialization, i.e. the tendency for financial overdevelopment of credit and asset markets to undermine real development outcomes such as growth, equality and resilience.

To test the theory of differentiated credit impacts, he built a novel bank credit data set together with colleagues, based on hand-collected central bank data spanning 70+ economies and going back to the 1990s. The disaggregated data set that Bezemer and colleagues built is freely available.

In political economy, explaining the growth of funded pension systems is a major project. Drawing on the financialization and growth models, Bezemer undertook a case study of the Dutch pension system to explain the remarkable expansion of pension funds since the 1980s. In this case study, the ageing-based rationalization of investments is questioned based on demographic and pension fund data. In the present era of managed money, the large costs of the funded system were obscured by the academic discourse on pension funds in terms of neoclassical models, treating pensions as financial assets. This fed into a policy discourse centered on continuous worries and painful reforms, leaving little policy space for alternatives to funded pensions. Insights from this case study have wider applicability to economies with funded pension systems.

Testimonial from Joris Stok, Coordinating advisor Council for the Environment and Infrastructure

"Recently, the Council for the Environment and Infrastructure (Rli) wrote a report on the role of the financial sector in the transition to a sustainable economy, with input from experts including Dirk. By highlighting the risks of 'Wall Street Consensus' policies - which stress financial transactions more than actual change in economy and society-, Dirk helped us to focus on measures with real impact. In this way, research feeds into the strategic policy advice of the Rli."

References:

Bezemer, D (2016) Towards an ‘accounting view’ on money, banking and the macroeconomy: history, empirics, theory. Cambridge Journal of Economics 40(5), 1275–1295

Bezemer, D., Samarina, A., & Zhang, L. (2020). Does mortgage lending impact business credit? Evidence from a new disaggregated bank credit data set. Journal of Banking & Finance, 113, 105760. https://doi.org/10.1016/j.jbankfin.20 20.105760

Bezemer, D., Ryan-Collins, J., Van Lerven, F., & Zhang, L. (2021). Credit policy and the ‘debt shift’ in advanced economies. SocioEconomic Review, 21(1), 437–478. https://doi.org/10.1093/ser/mwab041

Podcast: ‘Dirk bezemer on the future of Europe's capitalism’

Article newspaper Trouw: ‘Er is genoeg geld in nederland zegt econoom Dirk Bezemer het is jarenlang de verkeerde kant op gerold’